Table of Contents

- FDIC Insurance Update: What the New Rule Means for Your CD Beneficiaries

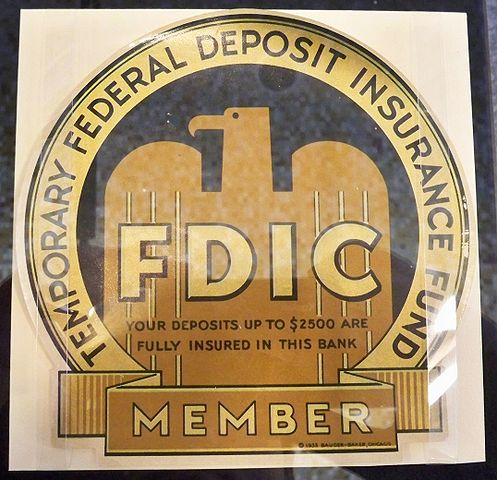

- Ashley Mihalik on LinkedIn: 90 Years of the FDIC

- FDIC Bank Closures: Is Your Money Safe? | Atlanta Daily World

- FDIC Issues Crypto-Related Cease and Desist Orders to 5 Companies ...

- US bank regulator FDIC requests input on digital assets - Ledger ...

- New Deal timeline | Timetoast timelines

- Deciphering Banking Acronyms: A Guide to Industry Lingo – Banking+

- FDIC Vice Chairman: Basel III Endgame Needs Re-Proposal

- President Appoints New Inspector General of FDIC – The Presidential ...

- FDIC insurance: What it is and how it works

What is the Federal Deposit Insurance Corp. (FDIC)?

How Does FDIC Insurance Work?

FDIC Insurance Limits

The FDIC provides insurance coverage up to $250,000 per depositor, per insured bank. This means that if you have deposits in multiple accounts at the same bank, the total insurance coverage is $250,000. However, if you have deposits in multiple banks, each bank's deposits are insured separately, up to $250,000. For example, if you have $200,000 in a checking account at Bank A and $200,000 in a savings account at Bank B, both deposits are fully insured, as each bank's deposit is below the $250,000 limit.